Forms & Documents

Access Essential Forms and Documents to

Streamline the Non-QM Financing Process

Forms & Documents

Access Essential Forms and Documents to

Streamline the Non-QM Financing Process

Forms & Documents

Access Essential Forms and Documents to Streamline the Non-QM Financing Process

Find All Your Required Forms & Documents Here

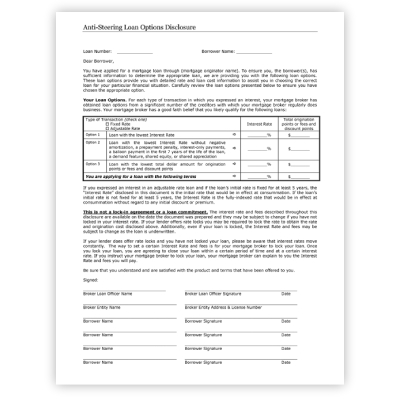

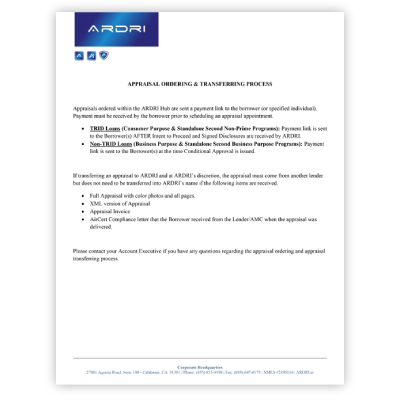

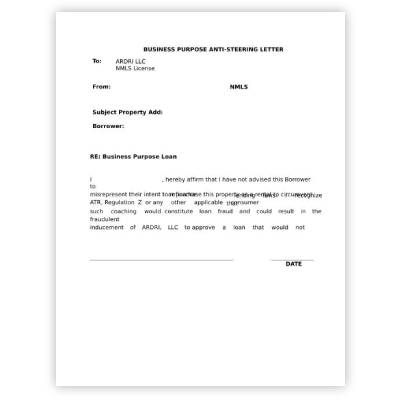

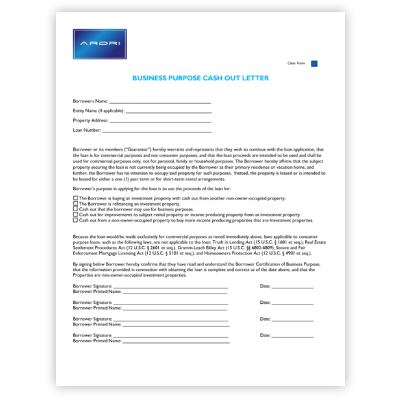

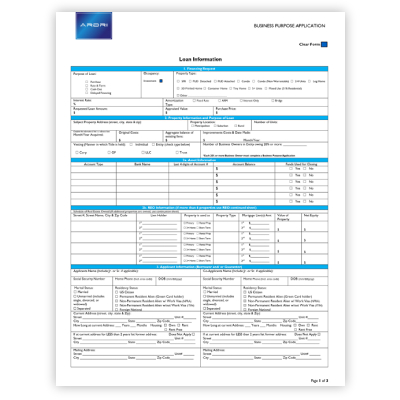

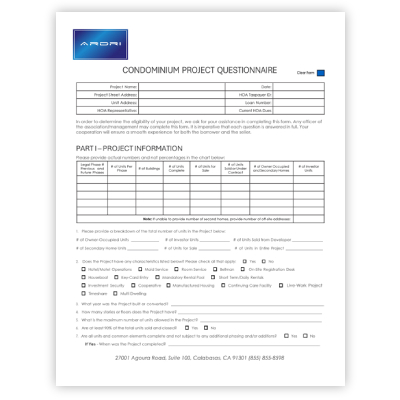

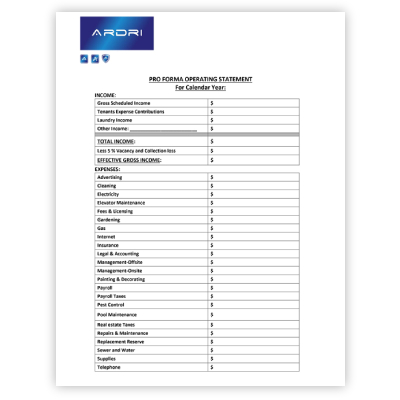

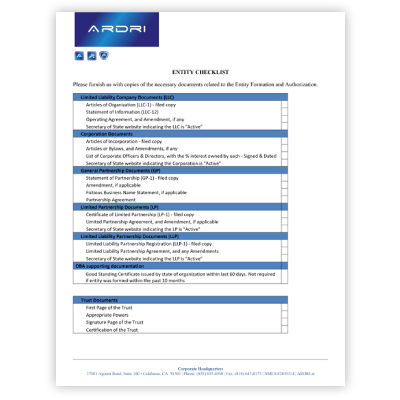

Our comprehensive library of forms and documents is designed to provide you with everything you need to navigate the lending process efficiently and confidently. Whether you’re a TPO mortgage broker or a business owner, you’ll find organized, easy-to-access resources tailored to your unique financing needs.

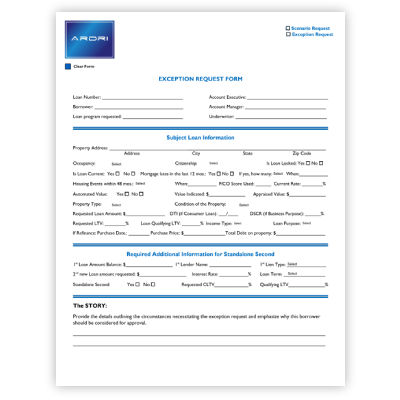

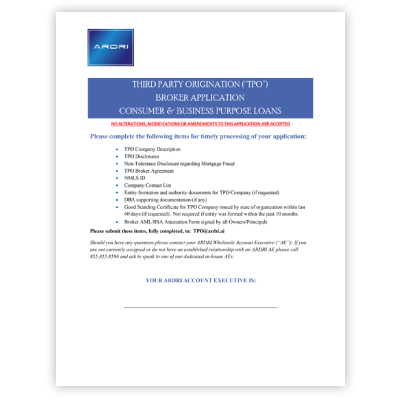

Required and must be approved by ARDRI for all Third Party Origination firms wanting to earn Lender Paid Compensation. Once approved, the pricing and eligibility engine will reflect Lender Paid Pricing automatically within the loan premium and Par pricing when selecting Borrower Paid Compensation.

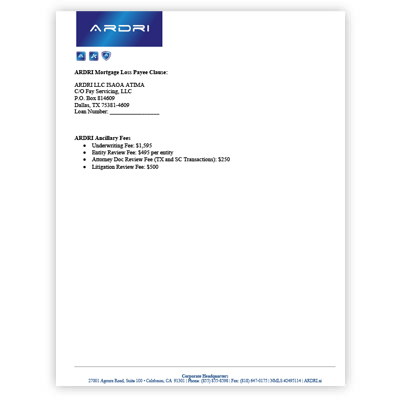

The Mortgage Loss Payee Clause is a provision in a property insurance policy that designates the lender (mortgagee) as the payee in the event of a loss. It provides security for the lender by guaranteeing that insurance proceeds will be used to repair or rebuild the property or to satisfy outstanding loan obligations in case…

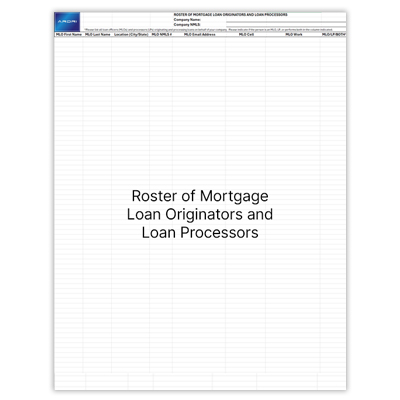

The Roster of Mortgage Loan Originators and Loan Processors spreadsheet allows brokers to input and add their employees to the ARDRI Hub. This helps ensure that all relevant team members are accurately registered within the ARDRI platform for streamlined communication and tracking.

The Mortgage Loss Payee Clause is a provision in a property insurance policy that designates the lender (mortgagee) as the payee in the event of a loss. It provides security for the lender by guaranteeing that insurance proceeds will be used to repair or rebuild the property or to satisfy outstanding loan obligations in case…

Required and must be approved by ARDRI for all Third Party Origination firms wanting to earn Lender Paid Compensation. Once approved, the pricing and eligibility engine will reflect Lender Paid Pricing automatically within the loan premium and Par pricing when selecting Borrower Paid Compensation.

The Mortgage Loss Payee Clause is a provision in a property insurance policy that designates the lender (mortgagee) as the payee in the event of a loss. It provides security for the lender by guaranteeing that insurance proceeds will be used to repair or rebuild the property or to satisfy outstanding loan obligations in case…

The Roster of Mortgage Loan Originators and Loan Processors spreadsheet allows brokers to input and add their employees to the ARDRI Hub. This helps ensure that all relevant team members are accurately registered within the ARDRI platform for streamlined communication and tracking.

All Forms & Documents

Required and must be approved by ARDRI for all Third Party Origination firms wanting to earn Lender Paid Compensation. Once approved, the pricing and eligibility engine will reflect Lender Paid Pricing automatically within the loan premium and Par pricing when selecting Borrower Paid Compensation.

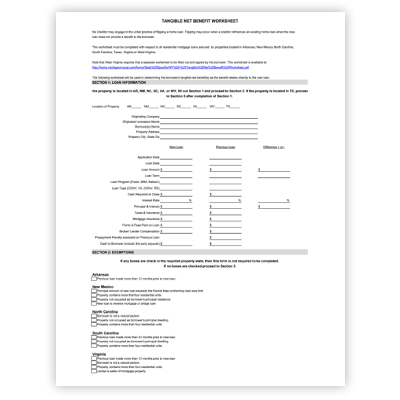

The Mortgage Loss Payee Clause is a provision in a property insurance policy that designates the lender (mortgagee) as the payee in the event of a loss. It provides security for the lender by guaranteeing that insurance proceeds will be used to repair or rebuild the property or to satisfy outstanding loan obligations in case…

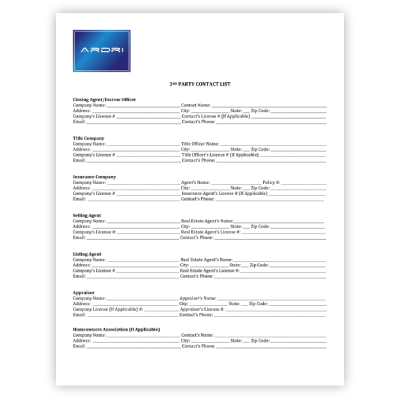

The Roster of Mortgage Loan Originators and Loan Processors spreadsheet allows brokers to input and add their employees to the ARDRI Hub. This helps ensure that all relevant team members are accurately registered within the ARDRI platform for streamlined communication and tracking.

Simplify Your Path to Non-QM Success

Join the many TPO brokers who trust ARDRI for their Non-QM and Business Purpose financing needs. Becoming an approved broker is quick and hassle-free—no financial information or credit checks are required. Unlock innovative solutions and personalized support with ARDRI—your trusted partner in navigating the Non-QM financing landscape. Start today!

Call us today at 855.855.8598 to learn more or get approved below!